Motor Vehicle Insurance

Hit the road with assurance! Our motor insurance not only shields your car from damage but also boosts your confidence, knowing you’re protected from all angles.

Product Highlights

Our Motor Vehicle Insurance covered for the cost incurred from

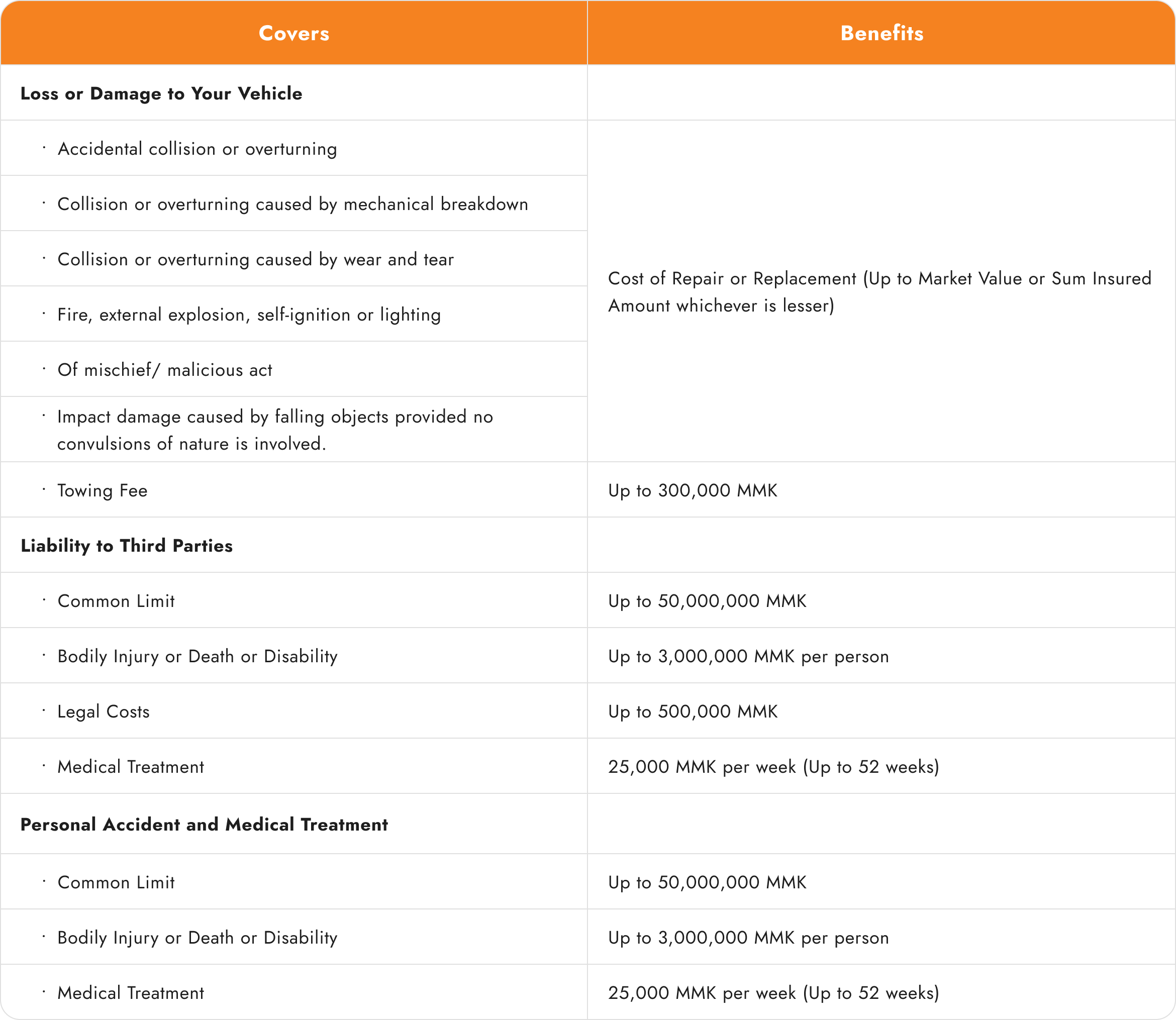

Loss or Damage to Your Vehicle

Liability to Third Parties

Personal Accident and Medical Treatment Fee

Basic Premium

Minimum of 1.072% to Maximum of 1.734% of the sum insured amount

Loading Premium

Maximum of 10% of the total premium, depending on utilization in a risk area and claim experience

Excess

Excess is the first amount that Insured has to bear in respect of each and every claim under the Policy.

Coverage & Benefits

What is Covered

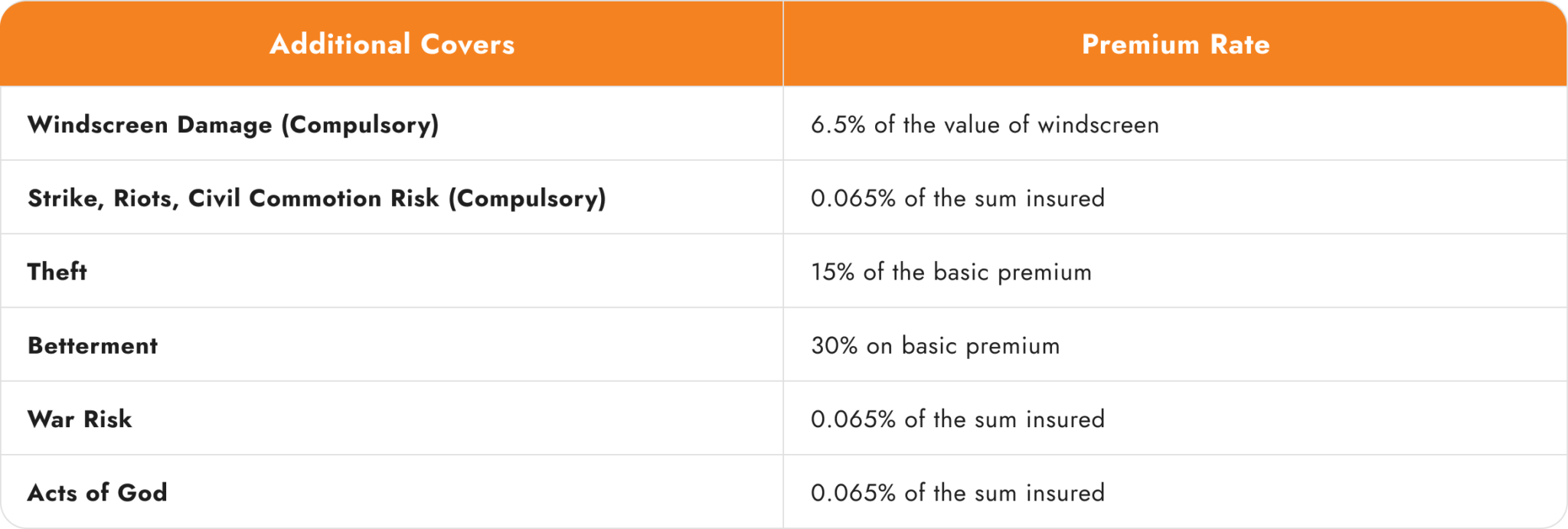

Additional Covers

Fleet Discount

No Claim Bonus (NCB)

Insurance Eligibility

What can be insured

Any vehicle that is legally registered with the Road Transport Administrative Department can be insured.

Period of Insurance

3 months, 6 months, 9 months or 1 year.

Related Products

Personal Lines Insurance

Personal Accident Insurance

Accidents can happen when you least expect it. Cover yourself and your loved ones in case of accidents or mishaps for your piece of mind.

Personal Lines Insurance

Health Insurance

Your health is your most important asset. Protect yourself and your family from medical and surgical expenses with KBZMS Arrawjan Health Insurance.

Personal Lines Insurance

Travel Insurance

Have a worry free journey Have a worry-free journey with our Domestic/ Overseas travel insurance, Under 100 miles travel insurance and Special travel insurance. Travel in style and secure in the knowledge that you are covered from unexpected travel issues.