Fire & Allied Perils Insurance

Safeguard your valuable assets and ensure a secure future with KBZMS’s Fire Insurance, offering comprehensive protection against unforeseen events.

Product Highlights

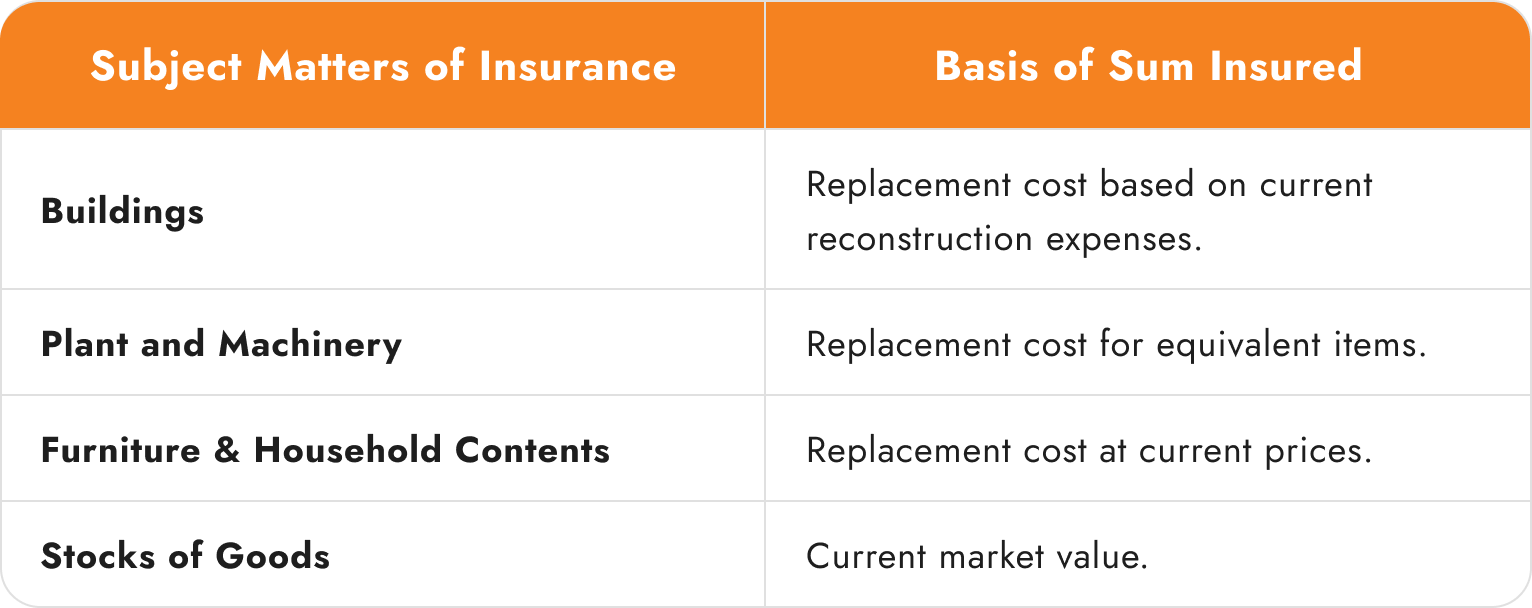

Properties you can buy fire insurance for

Buildings : Excludes land value.

Furniture and Household Contents

Plant, Machinery, Equipment, and Related Materials

Stocks of Goods : Includes production materials, raw materials, work-in-progress, and finished goods.

Stocks can be insured either in

Fixed Policy: Provides coverage based on a pre-determined sum insured, agreed upon at the policy’s inception, ideal for businesses with consistent inventory levels.

Declaration Policy: An annual policy offering flexible coverage for businesses with fluctuating inventory. The sum insured is adjusted monthly based on declared values, aligning with the Market Value at the time of loss.

Note: Declaration policy is designed for long-term (one-year) coverage and is not suitable for short-term insurance needs.

Basic Premium

In accordance with the tariff based on the classes of the building to be insured, its occupation, and its surrounding buildings, the premium ratings will vary from 0.20% to 3.5% on the sum insured.

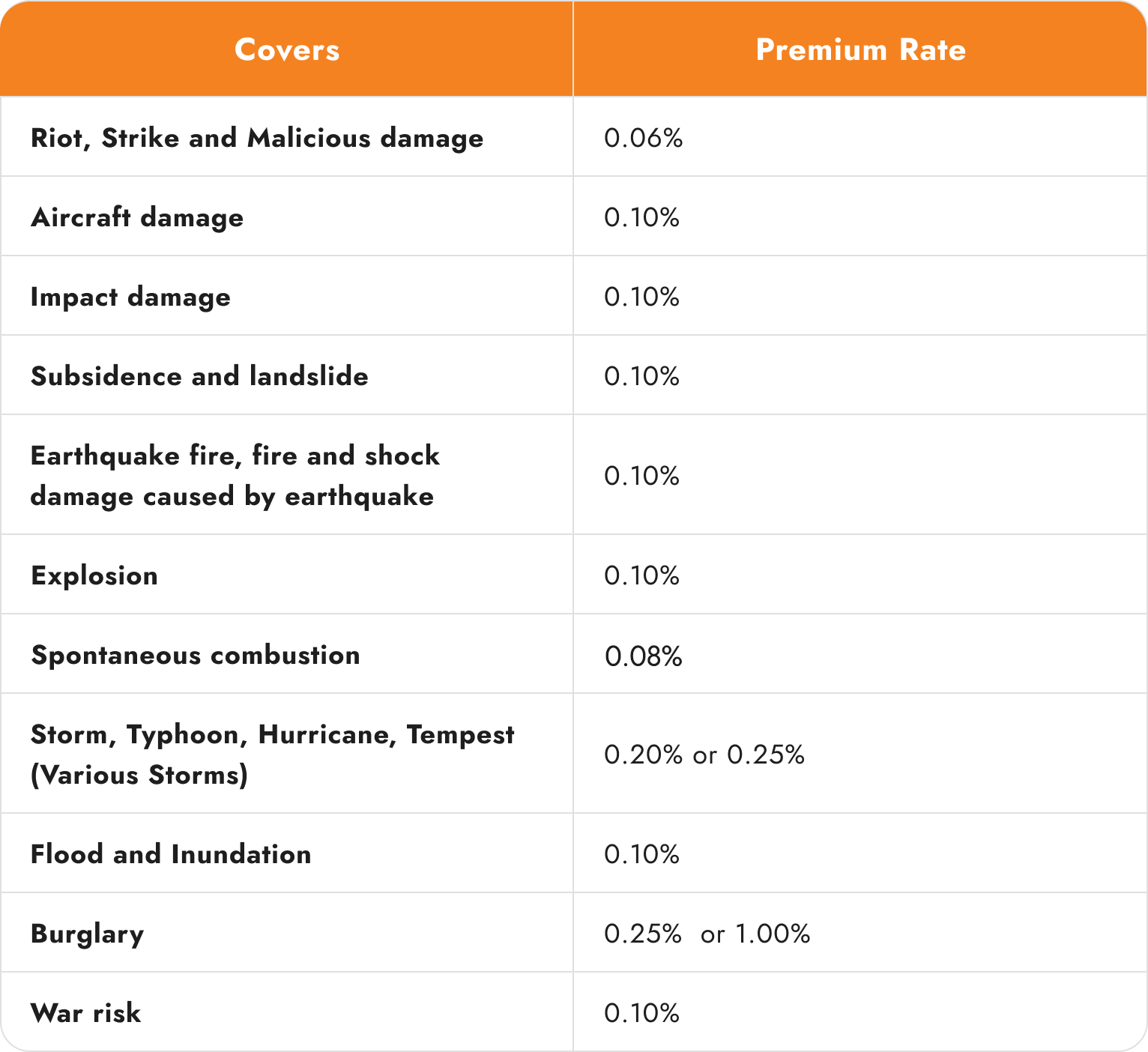

Additional Premium

Sum Insured

Coverage & Benefits

What is Covered

Basic Coverage

Fire

Lightning

Explosion of gas used for domestic purposes only

Additional Coverage

Riot, Strike and Malicious damage

Aircraft damage

Impact damage

Subsidence and landslide

Earthquake fire, fire and shock damage caused by earthquake

Explosion

Spontaneous combustion

Storm tempest – Storm, Typhoon, Hurricane, Tempest (Various Storms)

Flood and Inundation

Burglary

War risk

No Claim Bonus (NCB)

If no claims are made within a year, the insured may be eligible for a discount upon renewal. When renewing the policy, the total premium from the previous year is compared to the renewal premium for the current year. The insured will receive 25% of the lower premium as a no claim bonus.

Insurance Eligibility

Who can be Insured

Anyone who has an insurable interest has the right to be insured.

Period of Insurance

10 days, 1 month, 3 months, 6 months or 1 year

Related Products

Commercial Lines Insurance

Industrial All Risks Insurance (IAR)

Enjoy a wide scope of cover on your property with an Industrial All Risk policy that encompasses accidental loss and property damage. This includes damage caused by fire, flooding, earthquakes, etc.

Commercial Lines Insurance

Contractors’ All Risks/Erection All Risks Insurance(CAR/EAR)

During the construction and erection phases, KBZMS provides customized insurance solutions for risks ranging from transport, all the way to operational risks.

Personal Lines Insurance

Motor Vehicle Insurance

Our motor vehicle insurance not only safeguards against damage to your car but also covers damage to third parties. Drive with confidence, knowing both you and others are fully protected.